Diversified Investment in the top Blue Chip Digital Assets simply and securely The 1Valour STOXX Bitcoin Suisse Digital Asset Blue Chip ETP tracks the performance of top eligible blue chip digital assets, resulting in the product covering five sectors: Cryptocurrency, General Purpose Smart Contract Platform, Decentralized Finance (DeFi), Utility and Culture. The Bitcoin Suisse Global Crypto Taxonomy (GCT) is used to classify these digital assets into their representative sectors.

Valour’s Physical product line offers compliant Exchange Traded Products under EU regulations, with each product 100% physically backed and securely held in cold storage by licensed custodians. Traded on regulated exchanges, these ETPs provide transparent pricing and liquidity, ensuring investor confidence. Valour’s Base Prospectuses are approved by the Swedish Financial Supervisory Authority, meeting EU requirements for completeness, clarity, and consistency.

- Product Name1Valour STOXX Bitcoin Suisse Digital Asset Blue Chip

- IssuerValour Digital Securities Limited

- Base CurrencyEUR

- Management Fee1.9%

- ISINGB00BPDX1969

- ValorenBPDX196

- WKNA3G96Z

- Bloomberg CodeBCIX GR Equity

- Expiry DateOpen-ended

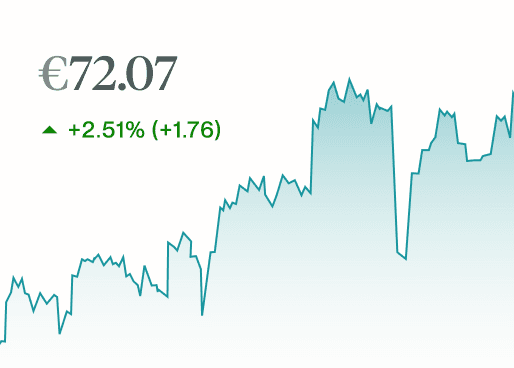

- Share Price0.7724EUR

- Outstanding Shares293818

Assets | Index Weight |

|---|---|

Bitcoin (BTC) | 30% |

Binance (BNB) | 16.95% |

Chainlink (LINK) | 2.23% |

Ethereum (ETH) | 30% |

Solana (SOL) | 15.41% |

Tron (TRX) | 4.58% |

Uniswap (UNI) | 0.82% |

STOXX Digital Asset Blue Chip Asset Allocation Pie Chart

Assets | Index Weight |

|---|---|

Bitcoin (BTC) | 30% |

Binance (BNB) | 16.95% |

Chainlink (LINK) | 2.23% |

Ethereum (ETH) | 30% |

Solana (SOL) | 15.41% |

Tron (TRX) | 4.58% |

Uniswap (UNI) | 0.82% |

STOXX Digital Asset Blue Chip Historical Asset Allocation Chart

The STOXX Digital Asset Blue Chip X Index provides exposure to assets within the underlying STOXX Digital Asset Blue Chip Index that trade on Xetra. Assets are selected based on a multi-step procedure which seeks to identify the strongest and most representative assets in each eligible sector of the Bitcoin Suisse Global Crypto Taxonomy. At each review, a set of crypto-specific review metrics are calculated and used to rank the assets within their respective sectors, with this, in turn, determining the final index composition. The index is market capitalization weighted and is reviewed on a quarterly basis in March, June, September and December.

ISS STOXX GmbH, through its group companies, is a leading provider of comprehensive and data-centric research and technology solutions that help capital market participants identify investment opportunities, detect qualitative and quantitative portfolio company risks, and meet evolving regulatory requirements. With roots dating back to 1985, ISS STOXX GmbH today delivers world-class benchmark and custom indices across asset classes and geographies and serves as a premier source of independent corporate governance, sustainability, cyber risk, and fund intelligence research, data, and related offerings.

Bitcoin Suisse AG, founded in 2013, is the Swiss crypto-finance and technology pioneer and market leader. As an enabler for the crypto and blockchain ecosystem in Switzerland, Bitcoin Suisse has been a driving force in the development of the 'Crypto Valley' and the 'Crypto Nation Switzerland'. The crypto-financial services provider offers brokerage, custody, lending, staking, payment solutions and other crypto-related services for private and institutional clients. As a member of the self-regulatory organization Financial Services Standards Association (VQF), Bitcoin Suisse is a financial intermediary subject to Swiss AML/CFT regulations. Bitcoin Suisse consists of several companies under the parent company BTCS Holding AG. The company is headquartered in Zug and has built a team of over 200 highly qualified experts in Switzerland and Europe.

Earn more while spending less with our competitive management fees.

Access the future of finance with the security of regulated listings and licensed offerings.

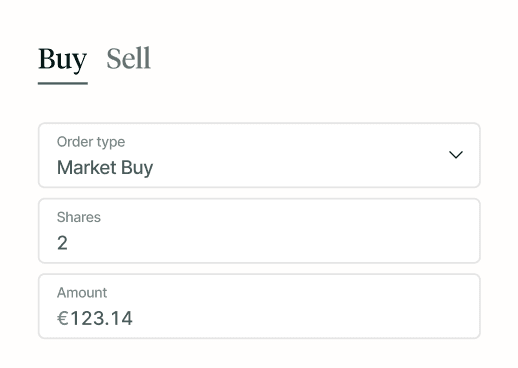

Trade Bitcoin and other digital assets without a dedicated crypto trading account.

Clear, consistent link between price of the ETPs and the underlying asset