Invest in Bitcoin simply, securely and sustainably. Valour Bitcoin Carbon Neutral ETP provides investors with sustainable and climate-friendly exposure to Bitcoin. The carbon neutral ETP presents a trusted investment option which benefits the environment and aligns with ESG goals by funding certified carbon removal and offset initiatives in order to neutralise the associated bitcoin carbon footprint.

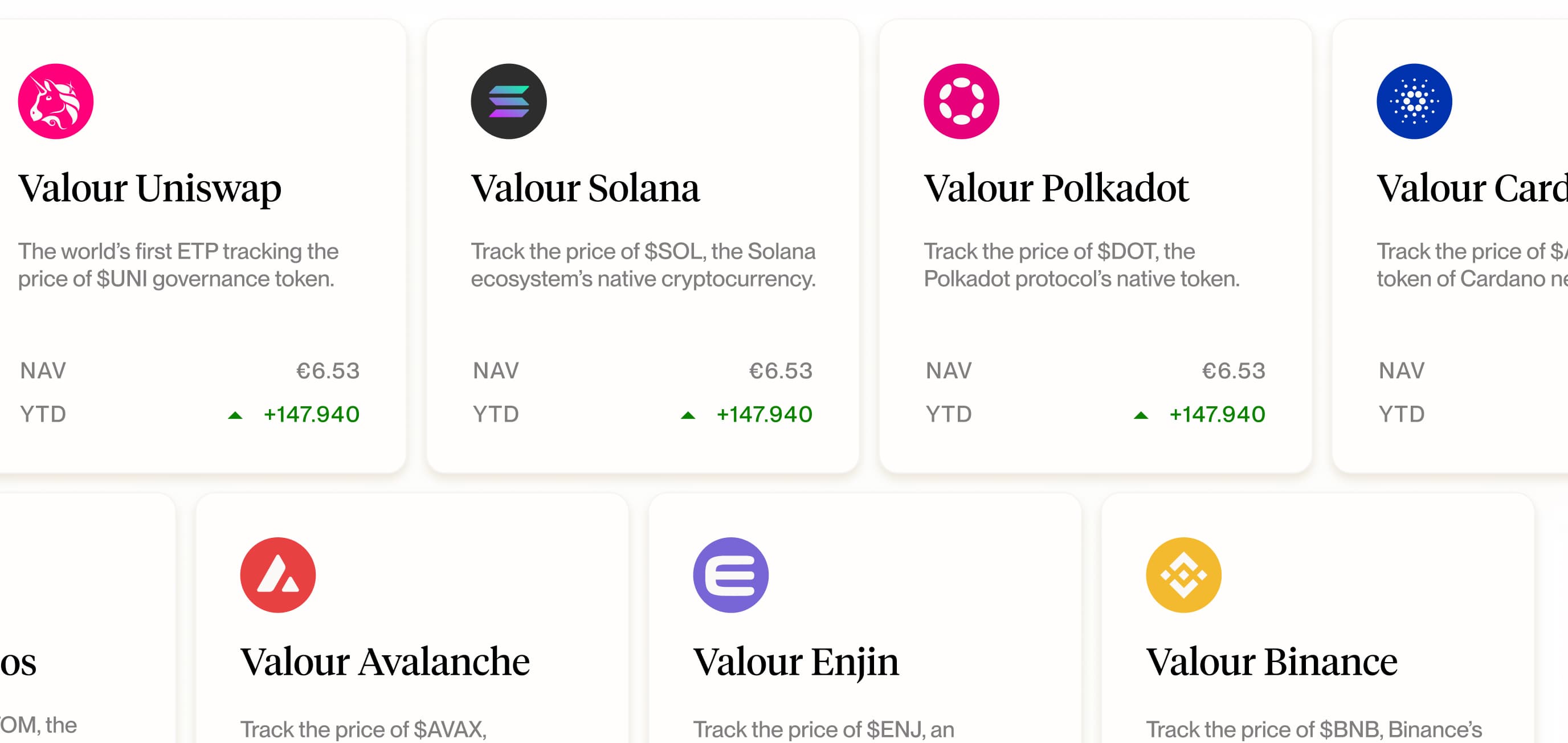

Valour’s Physical product line offers compliant Exchange Traded Products under EU regulations, with each product 100% physically backed and securely held in cold storage by licensed custodians. Traded on regulated exchanges, these ETPs provide transparent pricing and liquidity, ensuring investor confidence. Valour’s Base Prospectuses are approved by the Swedish Financial Supervisory Authority, meeting EU requirements for completeness, clarity, and consistency.

- Product Name1Valour Physical Bitcoin Carbon Neutral

- IssuerValour Digital Securities Limited

- Base CurrencyEUR

- Management Fee1.49%

- ISINGB00BQ991Q22

- ValorenN/A

- WKNA3G5PQ

- Expiry DateOpen-ended

Since its advent in 2009, blockchain technology has undergone widespread adoption, with Bitcoin retaining its status as the single, largest digital asset by market cap. Secured by its Proof-of-Work consensus, the Bitcoin network relies on computational power to validate transactions and provide network security. Given these energy requirements, Valour’s Bitcoin Carbon Neutral ETP aims to align investors looking to gain exposure to Bitcoin with zero carbon impact, aligning with ESG and SRI strategies.

Valour has partnered with experts at Patch to calculate the total emissions arising from its Carbon Neutral Bitcoin ETP. Patch’s methodology extends work from the academic community by using a bottoms-up approach to estimate the electricity consumption of the Bitcoin network. Electricity consumption is multiplied by a weighted average emissions factor, which incorporates regional energy mix and the geographic distribution of hash power, to compute the Bitcoin daily carbon footprint. Lastly, network-level emissions are mapped to individual bitcoins as a means of ascribing daily responsibility to market participants, thereby providing data used to calculate total emissions as a function of the Carbon Neutral Bitcoin ETP’s AUM linked to BTC.

Carbon offsetting refers to the act of reducing or removing carbon dioxide and other greenhouse gas emissions to compensate for emissions produced elsewhere. The process enables actors to pay other entities (agents) to reduce emissions that they are unable to reduce themselves through the purchase of credits. Each credit represents a metric ton of CO2e that has been averted from otherwise being produced, or, entirely removed from the atmosphere, with credits counting towards the company’s own emission targets.

Carbon credits include mitigation activities that are designed to reduce future emissions (avoidance) and those that actively reduce emissions by absorbing CO2e from the atmosphere (removal). Nature-based solutions (NbS) include methods for avoidance and removal that involve the use of natural features and processes, such as forest preservation and restoration. Clean energy solutions, such as renewable energy projects serve as an alternative method to offsetting emissions, whilst technological solutions, with Direct Air Capture (DAC) being the most notable, offer additional techniques for carbon credit projects.

Carbon credit projects are verified for their accuracy by independent parties who have established rigorous standards to certify and ensure the integrity of the carbon credits offered. Once verified, these credits are sold to entities looking to reduce their emissions via Voluntary Carbon Markets. Purchased credits can then be retired, enabling buyers to materialise measurable reductions in their total emissions.

In order to ensure the quality and integrity of carbon credits, a number of independent programs and standards exist to provide guidance and specification on the design, implementation, monitoring and reporting of projects. As well as verifying and certifying rules to ensure that projects perform as predicted, systems exist for the registration, tracking and enforcement of these credits. When selecting a standard or platform, consideration must be given to the standards’ methodologies and demonstrable mitigation of the associated risks.

There are a number of risks associated with the current landscape for carbon credits. Amongst the most significant challenges is ensuring that proposed emission reductions reflect the actual volume of CO2e that has been avoided or removed. This is complicated by the difficulty of establishing accurate models of what would otherwise have been. Further challenges arise when evaluating the permanence of projects given that no guarantee of permanent reductions can be made. Similarly, projects run the risk of leakage whereby reductions of emissions in one area are simply shifted elsewhere, negating the effectiveness of the emissions reductions. As such, it is imperative that projects be certified by trusted third parties who ensure the project’s compliance with standards and practices so as to mitigate these risks.

Through its partnership with Patch, Valour takes pride in using quality carbon credits to offset these emissions. Patch only selects high integrity projects that remove and sequester carbon dioxide from the atmosphere. Patch carefully selects projects, that are certified by approved and acclaimed global standards, including the Verified Carbon Standard (VCS), Gold Standard, Climate Action Reserve (CAR), BCarbon, and Puro.Earth. The criteria Patch uses to ensure projects deliver the highest impact are: additionality, permanence, real and verifiable, and negativity.

Valour is dedicated to making crypto greener and working with others to develop solutions that will accelerate the decarbonization of the industry. Whilst we acknowledge the need for additional carbon-neutral products, our current focus is on Proof-of-Work digital assets that are characterised by higher carbon footprints. Nonetheless, we are constantly evaluating the space and ensuring that our value proposition is aligned with our commitment to sustainable growth in the space.

Patch’s methodology extends the approach pioneered by Cambridge, Marc Bevand, and others in providing a figure for the real-time electricity consumption of the crypto network. We have selected Patch as our core partner given their meticulous verification process in determining that projects have been vetted by qualified and recognised organisations. The extensive criteria used in determining that projects deliver the highest impact make them an ideal fit for our decarbonization strategy, helping spearhead change across the industry.

Valour’s Carbon Neutral Bitcoin ETP applies a management fee to cover the cost of the carbon emissions associated with it. The exact methodology used in calculating the carbon credits can be found here.

Patch’s methodology takes a bottom-up approach in ascribing responsibility to network participants by mapping network-level emissions to transactions, thus ensuring fair accountability of individual holdings. By integrating Patch’s API-based solution, Valour selects high integrity carbon projects that remove and sequester carbon dioxide from the atmosphere in line with total emissions arising as a function of the [Carbon Neutral] Bitcoin -backed ETP’s AUM. These figures are updated daily and processed by Patch in accordance with Valour's carefully selected portfolio mix. Credits are assigned to Valour’s inventory at the end of each quarter and represent the equivalent amount of CO2 to be removed, in line with each credit’s specifics, namely, vintage.

Disclaimer: As with any financial strategy, investors should be aware of the risks and limitations involved. The information contained above is not exhaustive and should not be relied upon as the sole basis for making investment decisions. Investors should consult the base prospectus for complete information on the investment product, including its terms, conditions, and risks involved.

While the industry is actively engaged in improving energy systems and mining practices to accelerate a renewable transition, Bitcoin’s Proof-of-Work (PoW) consensus algorithm requires substantial computational power to validate and record transactions and ensure network security. This has prompted Valour’s issuance of a carbon-neutral Bitcoin product to enable investors to obtain their desired exposure to the world’s largest digital asset in a way which is aligned with their ESG and sustainability objectives.

Valour assesses its carbon credit project mix on a regular basis, only selecting those tat contribute towards its adherence of the Oxford University Principles for Net Zero Aligned Carbon Offsetting.

Valour’s mission is to democratise the future of finance by empowering investors to easily access industry leading technologies in the digital asset space.

In addition to bridging the gap between traditional capital markets and decentralised finance, Valour strives to ensure that its offerings promote sustainable practices and contribute to the transition to net zero greenhouse gas (GHG) emissions by 2030 and is a proud signatory of the Crypto Climate Accord.

Earn more while spending less with our competitive management fees.

Access the future of finance with the security of regulated listings and licensed offerings.

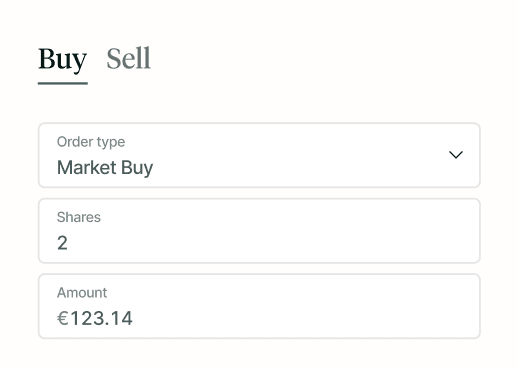

Trade Bitcoin and other digital assets without a dedicated crypto trading account.

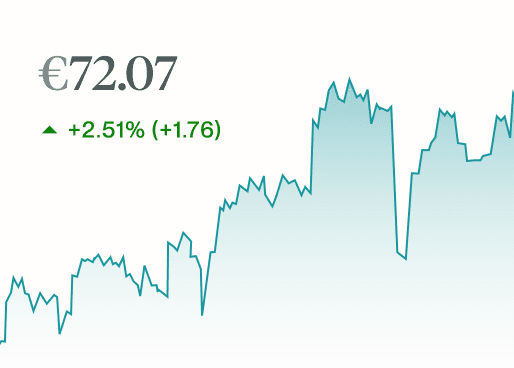

Clear, consistent link between price of the ETPs and the underlying asset