Valour Short Bitcoin (SBTC) is an exchange-traded product that inversely mirrors the movements of Bitcoin's price. It serves as an inverse tracker, catering to investors seeking to capitalize on or hedge against a decrease in the value of the Bitcoin. Designed for experienced investors aiming to leverage daily market fluctuations, Valour Bitcoin Short offers strategic exposures and a convenient means to make timely portfolio adjustments.

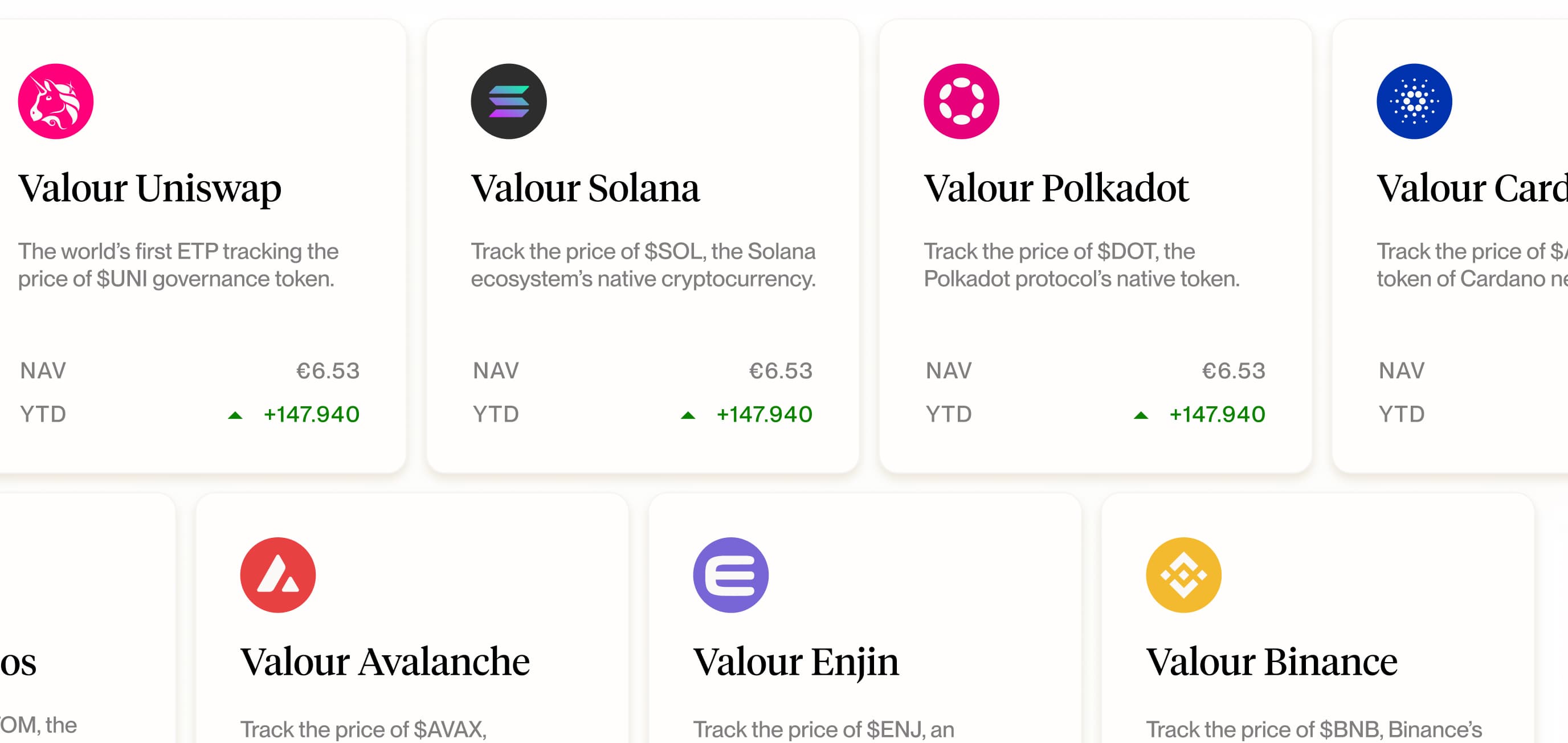

Valour’s Certificate product line offers compliant Exchange Traded Products, each fully hedged by their respective digital assets. To ensure secure cold storage, Valour partners with tier one licensed custodians such as Copper and Komainu. Traded on regulated exchanges and MTFs, these certificates provide transparent pricing and liquidity, reinforcing investor confidence in secure digital asset investments. Valour’s Base Prospectuses are approved by the Swedish Financial Supervisory Authority, meeting EU requirements for completeness, clarity, and consistency.

- Product NameValour Short Bitcoin SEK

- IssuerValour Inc.

- Base CurrencySEK

- Management Fee2.5%

- Borrowing Cost8%

- ISINCH1149139649

- Valoren114913964

- WKNA4AFMG

- Expiry DateOpen-ended

Yes, with a leverage of -1. An important difference is that Valour Short Bitcoin tracks spot Bitcoin and not an underlying index of futures.

The Valour Short Bitcoin ETP is intended for experienced investors, who aim to capitalize on short-term fluctuations in the underlying asset's price. This product is not designed for meeting a longterm bearish view on Bitcoin's price, due to the effect of the borrowing cost on its performance.

Due to the relatively high borrowing cost, it is not recommended to hold the product for longer time horizons. Suitable holding periods are short term, where the impact of the borrowing cost is low.

In order to hedge its position, the issuer will borrow the relevant, corresponding digital asset on a 1:1 basis and sell the asset short. When lending Bitcoin, a yearly borrowing cost of 8% is applicable. This cost is subject to the lending market price, and fluctuates in a similar way that flexible interest rates seen in housing loans or savings accounts fluctuates.*The current borrowing cost stands at 8%.

In order to hedge its exposure to the underlying digital asset originating from the sale of the certificates, the issuer will borrow the relevant, corresponding digital asset on a 1:1 basis and sell the asset short. Borrowing Bitcoins will induce a borrowing cost.

Short ETPs present a high level of risk and are most suitable for experienced investors with a robust risk appetite who are prepared to bear potential losses. Variations in the performance of Short ETPs from the underlying asset can arise due to fees and/or borrowing expenses.For detailed information about the risks, see the "Risk" sections of the base prospectus.

The tracking accuracy of Short ETPs may be compromised by various factors, and in the case of Valour Short Bitcoin especially because of the borrowing cost, if the product is held over a long period of time. Consequently, deviations from the desired exposure can occur, impacting investment returns.

Disclaimer: As with any financial strategy, investors should be aware of the risks and limitations involved. The information contained above is not exhaustive and should not be relied upon as the sole basis for making investment decisions. Investors should consult the base prospectus for complete information on the investment product, including its terms, conditions, and risks involved.

Earn more while spending less with our competitive management fees.

Access the future of finance with the security of regulated listings and licensed offerings.

Trade Bitcoin and other digital assets without a dedicated crypto trading account.

Clear, consistent link between price of the ETPs and the underlying asset