Get exposure to Bitcoin while receiving a 5.65% yield - all without the need to sell or trade Bitcoin. Valour Bitcoin Staking (BTC) is an exchange-traded product making an investment in the world’s best-known digital asset easier and more secure, all while receiving a yield that is attributed to the NAV on a daily basis.

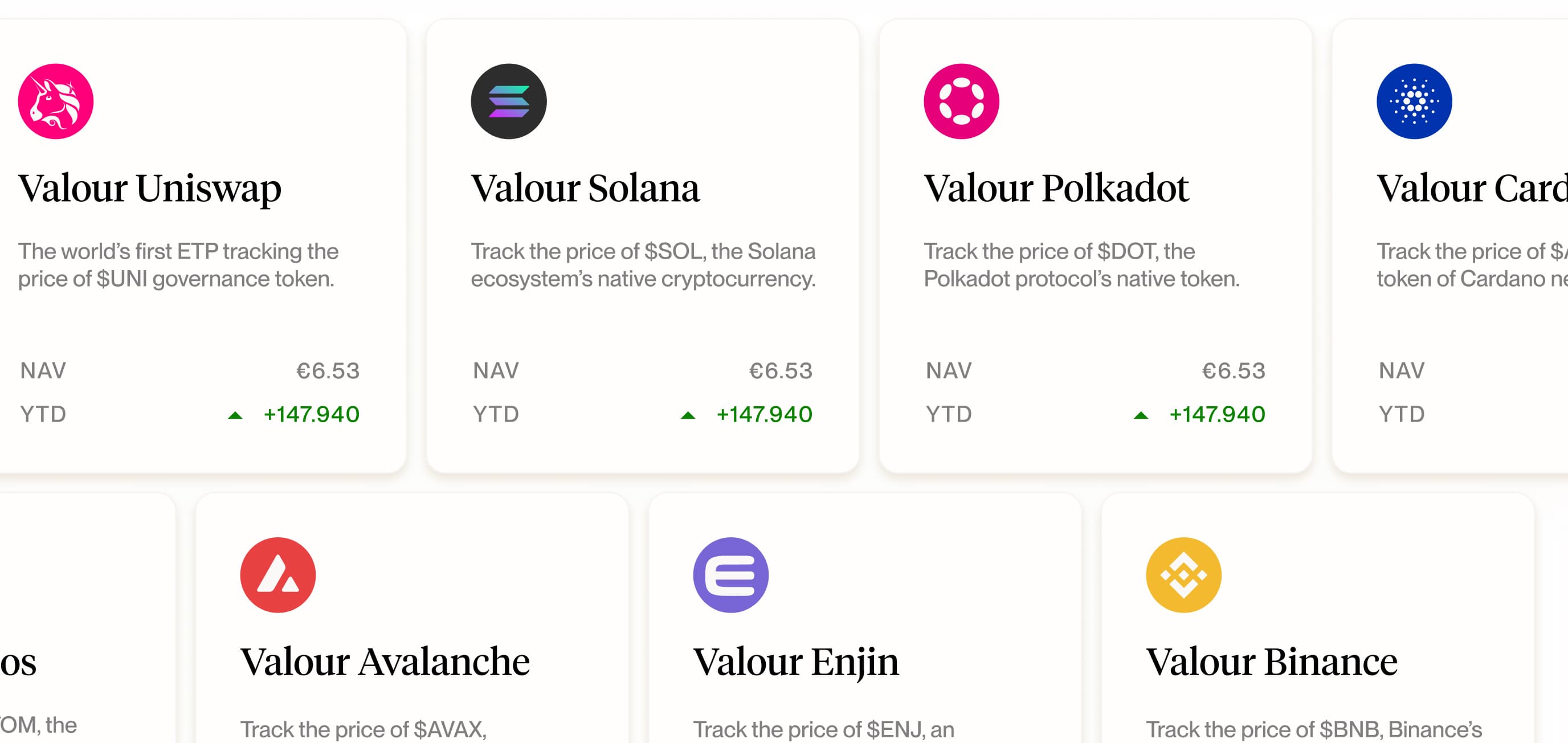

Valour’s Certificate product line offers compliant Exchange Traded Products, each fully hedged by their respective digital assets. To ensure secure cold storage, Valour partners with tier one licensed custodians such as Copper and Komainu. Traded on regulated exchanges and MTFs, these certificates provide transparent pricing and liquidity, reinforcing investor confidence in secure digital asset investments. Valour’s Base Prospectuses are approved by the Swedish Financial Supervisory Authority, meeting EU requirements for completeness, clarity, and consistency.

- Product NameValour Bitcoin Staking

- IssuerValour Inc.

- Base CurrencyEUR

- Management Fee1.9%

- Yield5.65%

- ISINCH1213604544

- Valoren121360454

- WKNA4AG5K

- Bloomberg CodeN/A

- Expiry DateOpen-ended

Yes, the underlying Bitcoins remain at all times within the ETP designated wallet, where they are locked for a short-term lock up period. By doing so, the yield is generated on the Core Chain, and the CORE Tokens are contributed to a separate Core wallet and converted on a daily basis into bitcoins, which are then contributed to the ETP designated wallet and NAV.

Valour’s staking ETPs are accumulating products whereby staking reward is added to each qualifying product’s Digital Asset entitlement and reflected in the Net Asset Value (NAV) at the end of each trading day.

Valour Bitcoin Staking (BTC) ETP makes it possible to easily and securely gain exposure to the world's most well-known digital asset, Bitcoin, while also receiving yield.

Investors get easy exposure to bitcoin while also making the asset productive, generating yield for the investor.Investors get easy exposure to bitcoin while also making the asset productive, generating yield for the investor.

No, security is not decreased during staking. All custodial control is retained while yield is generated. Bitcoins are staked through a ‘stake transaction’, a specific type of native Bitcoin transaction that includes a short-term lockup period and Core Chain staking details, such as the Core Validator to point the stake to and the Core reward address. During the lockup, the Bitcoins can't be transferred or slashed. Valour retains control of underlying Bitcoins which remains with Valour's regulated custodian.

Core Chain is a decentralised, secure, scalable, and EVM compatible layer 1 blockchain, backed by Bitcoin’s Proof-of-Wprk through a unique consensus mechanism called 'Satoshi Plus'. Satoshi Plus allows Bitcoin miners to delegate their PoW (DPoW) to Core validators by repurposing their existing work without affecting their future Bitcoin rewards. Core Chain unlocks the power of Bitcoin-secured decentralized applications.

Yield is generated by delegating Bitcoins to a validator on the Core Chain through non-custodial, native Bitcoin staking. The staked Bitcoins receive staking rewards in the form of CORE tokens on a separate wallet, which are converted into Bitcoins and attributed to the ETP’s NAV and ETP wallet on a daily basis.

Disclaimer: As with any financial strategy, investors should be aware of the risks and limitations involved. The information contained above is not exhaustive and should not be relied upon as the sole basis for making investment decisions. Investors should consult the base prospectus for complete information on the investment product, including its terms, conditions, and risks involved.

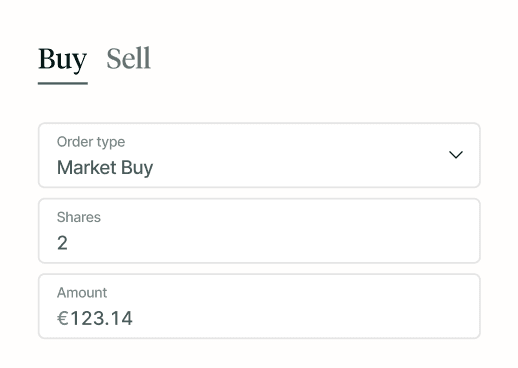

Earn more while spending less with our competitive management fees.

Access the future of finance with the security of regulated listings and licensed offerings.

Trade Bitcoin and other digital assets without a dedicated crypto trading account.

Clear, consistent link between price of the ETPs and the underlying asset