Diversified Investment in the Top 10 Digital Assets simply, and securely The Valour Digital Asset Basket 10 (VDAB10) ETP tracks the performance of the top 10 largest crypto assets based on market capitalization with a cap of 30% for any constituent, providing investors a diversified exposure to the evolving crypto landscape.

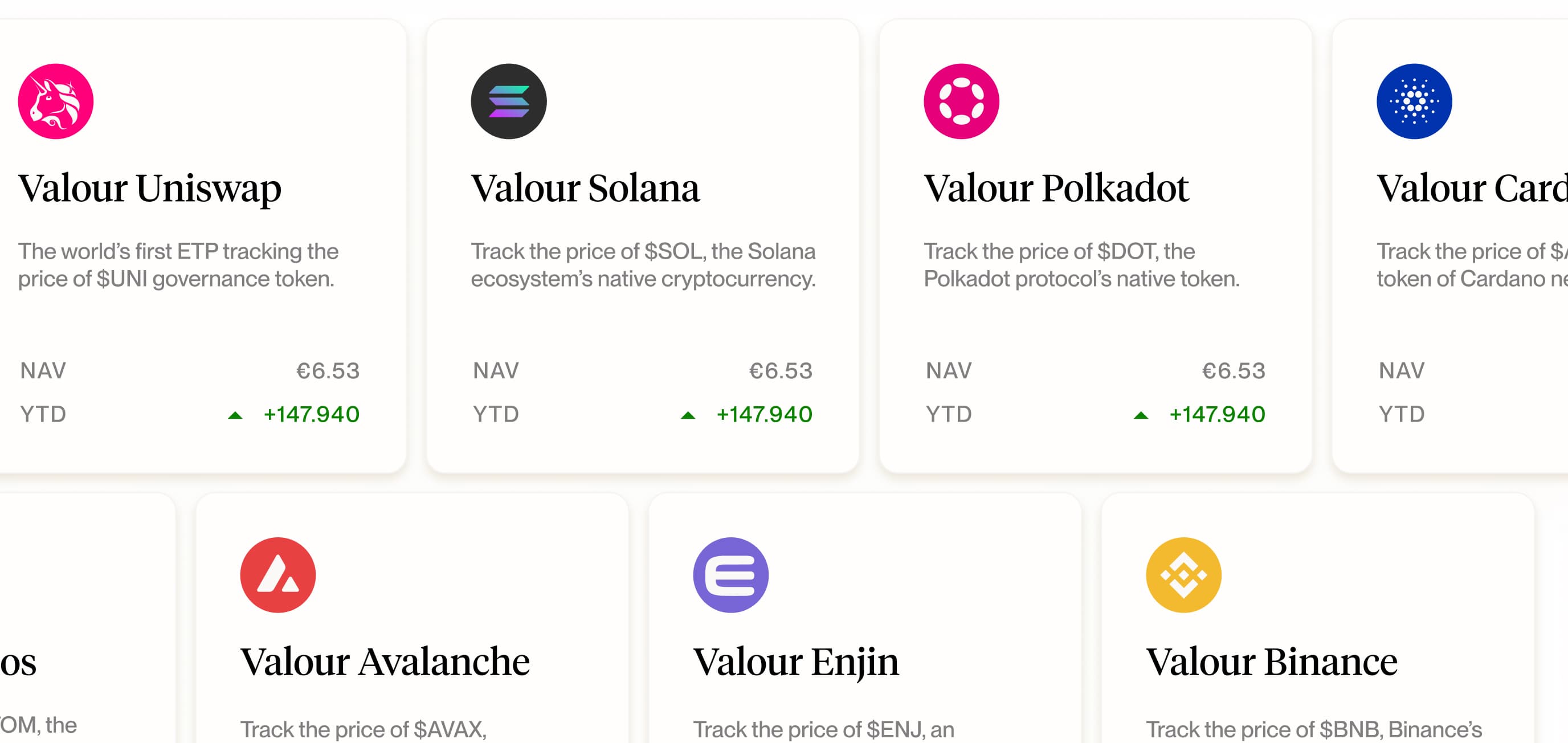

Valour’s Certificate product line offers compliant Exchange Traded Products, each fully hedged by their respective digital assets. To ensure secure cold storage, Valour partners with tier one licensed custodians such as Copper and Komainu. Traded on regulated exchanges and MTFs, these certificates provide transparent pricing and liquidity, reinforcing investor confidence in secure digital asset investments. Valour’s Base Prospectuses are approved by the Swedish Financial Supervisory Authority, meeting EU requirements for completeness, clarity, and consistency.

- Product NameValour Digital Asset Basket 10

- IssuerValour Inc.

- Base CurrencyEUR

- Management Fee1.9%

- ISINCH1149139623

- Valoren114913967

- WKNA3G03U

- Bloomberg Code2601216D SS

- Expiry Date114913967

- Average Price2342.4028USD

- Exchange Rate0.8631EUR

- Multiplier×0.0947726

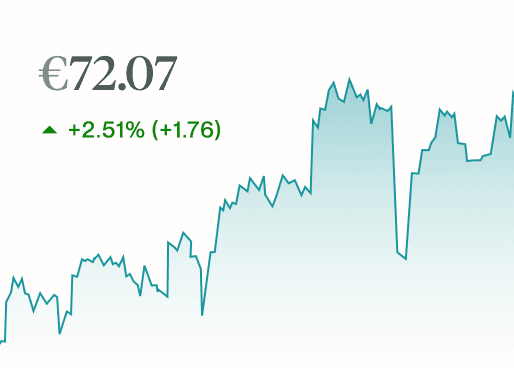

- ETP Price222.00EUR

Assets | Index Weight |

|---|---|

Bitcoin (BTC) | 30% |

Binance (BNB) | 12.36% |

Bitcoin Cash (N/A) | 1.21% |

Cardano (ADA) | 1.32% |

Chainlink (LINK) | 0.88% |

Dogecoin (DOGE) | 2.14% |

Ethereum (ETH) | 30% |

Ripple (XRP) | 11.89% |

Solana (SOL) | 7.33% |

Tron (TRX) | 2.87% |

The Valour Digital Asset Basket 10 Index ("VDAB10") tracks the 10 largest Digital Assets based on the average monthly market capitalization on the 15th calendar day of the month, for the two most recent months. The constituents are weighted by their current market capitalization, with a maximum weight of 30%. If a constituent exceeds the maximum weight, its weight will be reduced to the maximum weight and the excess weight will be redistributed proportionally across all other index components. This process is repeated until no component has a weight exceeding the maximum weight. The selection of constituents and their target weights is rebalanced quarterly on the last business day of the month.

Vinter is an index provider for crypto assets that works with leading issuers in Europe to create exchange-traded products. Vinter developed the first crypto indices in the Nordics approved by the European Securities and Markets Authority (ESMA). Vinter introduces crypto assets to the traditional financial industry and reliable pricing and trust to the blockchain community.

Valour has teamed up with Vinter to create the Vinter Valour Benchmark Family, which is a family of benchmarks, owned by Valour Inc. and administered and calculated by Invierno AB . The benchmarks are developed to provide a rules-based and transparent way to track the value of a portfolio of cryptographic assets.

Each index measures the value of an investment strategy. The governing rules of the relevant Index, including the methodology of the Index for the selection and the rebalancing of the components of the Index, description of market disruption events, and adjustment rules are based on predetermined and objective criteria as defined in this methodology.

This methodology clearly determines what constitutes an active market for the purposes of each index, and establishes the priority given to different types of input data. The methodology takes into account factors like the size and liquidity of the market, the transparency of trading, the positions of market participants, market concentration, and the adequacy of any sample to represent the market or economic reality that the benchmark is intended to measure.

STOXX Digital Asset Blue Chip Asset Allocation Pie Chart

Assets | Index Weight |

|---|---|

Bitcoin (BTC) | 30% |

Binance (BNB) | 12.36% |

Bitcoin Cash (N/A) | 1.21% |

Cardano (ADA) | 1.32% |

Chainlink (LINK) | 0.88% |

Dogecoin (DOGE) | 2.14% |

Ethereum (ETH) | 30% |

Ripple (XRP) | 11.89% |

Solana (SOL) | 7.33% |

Tron (TRX) | 2.87% |

Earn more while spending less with our competitive management fees.

Access the future of finance with the security of regulated listings and licensed offerings.

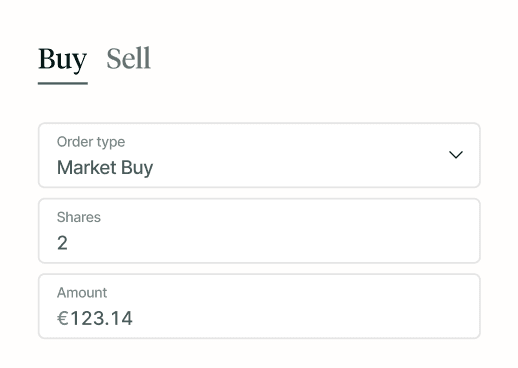

Trade Bitcoin and other digital assets without a dedicated crypto trading account.

Clear, consistent link between price of the ETPs and the underlying asset