Valour Tether Gold (XAUT) SEK is an exchange-traded product that tracks XAUt, a digital asset backed by physical gold. Each XAUt token represents ownership of one troy ounce of gold held in secure Swiss vaults. XAUt, also known as Tether Gold, combines the stability of gold with the flexibility of blockchain technology, allowing users to trade, store, and transfer gold digitally.

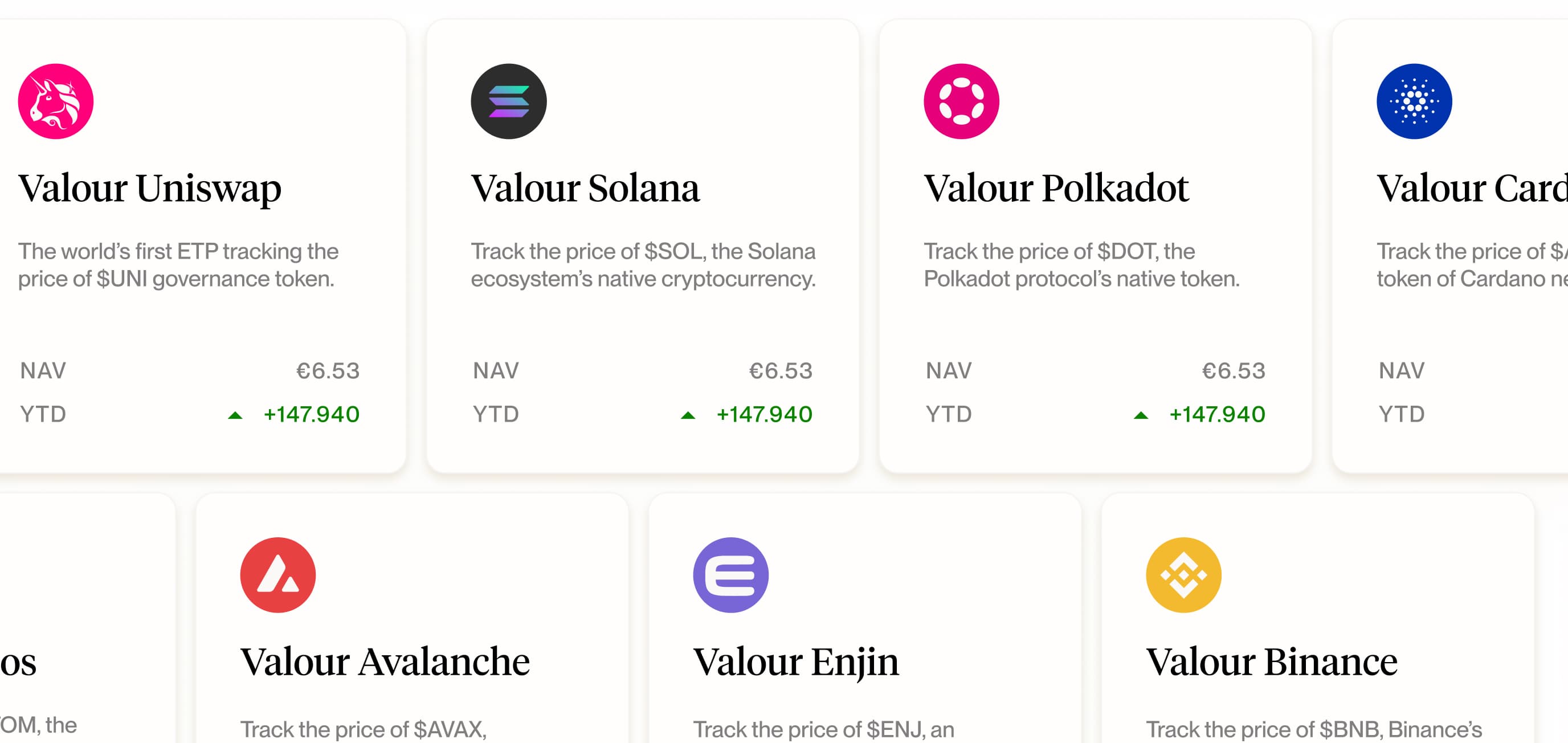

Valour’s Certificate product line offers compliant Exchange Traded Products, each fully hedged by their respective digital assets. To ensure secure cold storage, Valour partners with tier one licensed custodians such as Copper. Traded on regulated exchanges and MTFs, these certificates provide transparent pricing and liquidity, reinforcing investor confidence in secure digital asset investments. Valour’s Base Prospectuses are approved by the Swedish Financial Supervisory Authority, meeting EU requirements for completeness, clarity, and consistency.

- Product NameValour Tether Gold SEK

- IssuerValour Inc

- Base CurrencySEK

- Management Fee0.45%

- ISINCH1108679981

- Valoren110867998

- WKNA4A5JE

- Bloomberg Code2573570D SS

- Expiry DateOpen-ended

Tether Gold (XAUt) is a digital token that represents ownership of one fine troy ounce (approximately 31.1 grams) of physical gold on a specific gold bar that meets the London Bullion Market Association (LBMA) Good Delivery standard. The gold is securely stored in a Swiss vault, and the token is issued by Tether, the company also behind the USDT stablecoin.

Each XAUt token is fully backed by physical gold and represents ownership of a specific gold bar. Tokens are available on the Ethereum (ERC-20) and TRON (TRC-20) blockchains and can be transferred between users or held in compatible wallets

No, holders of the Valour Tether Gold (XAUt) Valour Tether Gold (XAUt) ETP cannot redeem it for physical gold. Only holders of the actual XAUt token—outside of the Valour Tether Gold (XAUt) ETP—can request redemption, and a minimum of 430 XAUt (about 13.3 kg of gold) is required.

XAUt is issued on Ethereum (as an ERC-20 token) and TRON (as a TRC-20 token). This means the token can be moved and tracked on-chain, though the Valour Tether Gold (XAUt) ETP holder does not interact directly with this infrastructure.

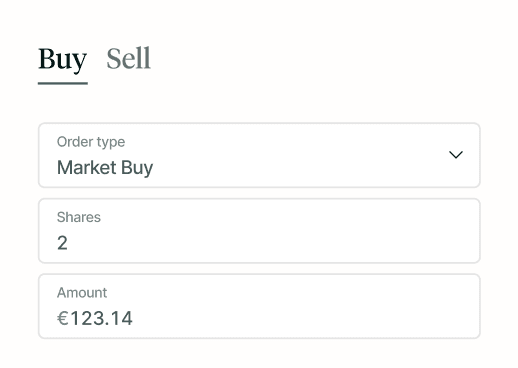

Valour charges 0.45% yearly for the holder of the Valour Tether Gold (XAUt) ETP.

The Valour Tether Gold (XAUt) ETP allows you to gain exposure to Tether Gold within traditional investment or brokerage accounts. It offers digital gold exposure without the need to manage private keys or interact with blockchain infrastructure.

The Valour Tether Gold (XAUt) ETP carries typical risks, as outlined in the base prospectus. Additionally, there is counterparty risk associated with Tether, the issuer of the underlying XAUt token, including reliance on its claim of full physical gold backing.

The Valour Tether Gold (XAUT) ETP offers exposure to physical gold without leaving the digital asset space. It combines the stability of gold with the flexibility and transparency of blockchain technology, making it a natural fit for investors already active in digital markets.

Valour Tether Gold (XAUT) ETP is suitable for investors who want blockchain-based gold exposure within a traditional brokerage account, without having to manage wallets, keys, or decentralized applications.

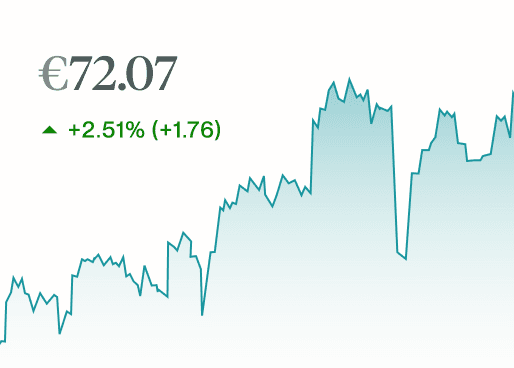

The price of the Valour Tether Gold (XAUt) ETP closely tracks the market value of the underlying XAUt token, which in turn is tied to the spot price of gold. Market makers help ensure liquidity and price alignment during trading hours.

Yes. The Valour Tether Gold (XAUt) ETP provides a low-cost, regulated way to hold exposure to tokenized gold, making it a suitable long-term hedge against inflation, currency risk, and market volatility—especially for those interested in blockchain-based assets.

Disclaimer: As with any financial strategy, investors should be aware of the risks and limitations involved. The information contained above is not exhaustive and should not be relied upon as the sole basis for making investment decisions. Investors should consult the base prospectus for complete information on the investment product, including its terms, conditions, and risks involved.

Earn more while spending less with our competitive management fees.

Access the future of finance with the security of regulated listings and licensed offerings.

Trade Bitcoin and other digital assets without a dedicated crypto trading account.

Clear, consistent link between price of the ETPs and the underlying asset